Liquidity for investors in real estate syndications.

Whether you are a limited partner or general partner in a commercial real estate syndication, our loans can provide you with immediate liquidity to keep growing your portfolio, all without a sale of your ownership interest.

LIQUIDITY FOR LIMITED PARTNERS & GENERAL PARTNERS

Liquidity for investors in

real estate syndications.

Whether you are a limited partner or general partner in a commercial real estate syndication, our loans can provide you with immediate liquidity to keep growing your portfolio, all without selling your ownership interest.

The advantages to borrowing against your ownership interest

Our loans were created for both passive and managing members

Whether you are a passive investor in a commercial real estate partnership or the general partner who put it all together, our financing can provide you with liquidity.

General partners can receive a loan secured by not only their common equity investment, but also their sponsor promote, which is their disproportionate share of profit above a preferred return given to their limited partners.

Try to find a lender who has closed as

many of these loans as we have. We'll wait.

$1 Million Loan on a 30% DST Interest

Our borrower owned 30% of a delaware statutory trust syndication with a stabilized 189-unit apartment community.

$7.2 Million Loan on a 48% TIC Interest

Our borrower owned a 48% tenants-in-common interest in a portfolio of industrial properties leased to a credit tenant.

$1.5 Million Loan on a 50% LLC Interest

Our borrower owned 50% of this income producing office building but quickly needed capital for another investment opportunity.

Three simple steps

to unlock your equity

Apply

Provide us with basic due diligence to underwrite your commercial property and determine fair market value.

Term Sheet

Review and execute our term sheet which will outline all of the loan terms and costs associated with it.

Closing

Our attorney will draft the loan documents and once signed the funds will be wired directly to your bank.

Loan terms tailored

to meet your needs

We put our borrower's needs first. We care about what you care about. You tell us what

matters the most to you and we’ll create loan terms tailored to meet your individual needs.

-

Loan Size

$500K - $5 Million

-

Geography

Nationwide

-

Term

1-3 Years

-

Interest Rate

12% I/O

-

Points

2-4%

-

Closing

2 weeks

-

Entity Types

LLC, LP, TIC, & DST

-

Property Types

Multifamily, office, retail, self-storage, industrial, & warehouse.

Who is your typical borrower?

Our borrowers are experienced and sophisticated commercial real estate investors who are asset rich but temporarily liquidity poor with the need to quickly access capital in order to take advantage of a time sensitive situation.

Does the property have to be income producing?

While we will entertain minor value-add projects on a case-by-case basis, we have a strong preference for completely stabilized and cash-flowing properties with historically strong occupancies. Under no circumstances will we lend on any land, construction, special-use, or owner-occupied properties.

Am I allowed to pledge my ownership interest to you?

QuickLiquidity will review your operating or partnership agreement to ensure our transaction is allowed. In cases where your agreement prohibits a pledge of your ownership interest, we have a strong track record of either obtaining the managing member or general partners permission or being able to creatively structure the deal without needing their consent.

Why you’ll love

working with us

We are a family-owned firm bringing discretionary capital and superior knowledge

to the table, allowing us to quickly close loans regardless of size, location, or complexity.

Direct Lender

QuickLiquidity is a direct lender for all transactions. We have complete discretion over our capital and no outside approval is required for us to close.

Brokers Protected

We protect all brokers who submit deals to us by adding them to our term sheet and ensuring they are paid off the HUD-1 at closing.

Family Business

QuickLiquidity is a family-owned firm. When working with us you'll always be able to speak directly to the decision-makers, not middlemen.

Certainty of Execution

You can have peace of mind when working with us. QuickLiquidity has built a reputation for reliability and has a proven track record of closing loans.

Quick Closings

QuickLiquidity specializes in time-sensitive transactions and can fund even the most complicated loan in as little as two weeks.

Flexible Terms

You tell us what matters the most to you and we’ll create loan terms tailored to meet your individual needs. We care about what you care about.

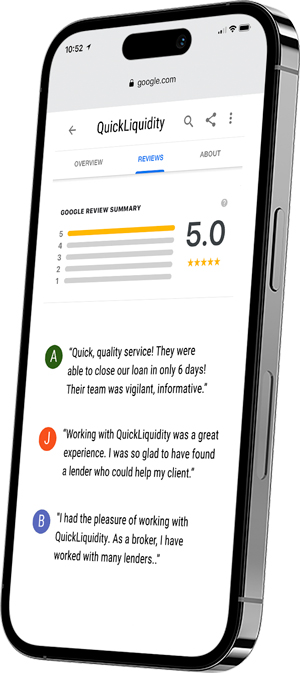

You don't have to

take our word for it

Usually you'd see a creative tagline here created by a marketing team.

Instead, we thought you should hear directly from our borrowers.

They closed our loan in only 6 days! I’ve worked with many lenders for over 20+ years and this was by far the fastest and most pleasant experience.

Alicia N.

Working with QuickLiquidity was a great experience. As a mortgage banker for 40 years, I would gladly recommend QuickLiquidity as a reliable source.

Janet P.

QuickLiquidity is amazing. They worked Thanksgiving Day and, on the weekend, to close the loan in 5 business days!

Karen S.

I have over 30 years of lending and broker experience. QuickLiquidity has been the most responsive and positive experience I have had with any lender.

Lynn R.

Ready to unlock

your trapped equity?

Apply today and receive a

term sheet within 24 hours.

Send us a message or call us at (561) 221-0881 to get started.